You tap a button on your phone, and a car shows up with no driver, just a smooth, silent ride ready to take you across town. That’s a robotaxi. And it’s not some sci-fi idea anymore. It’s already happening in cities like San Francisco and Phoenix, and it’s growing fast.

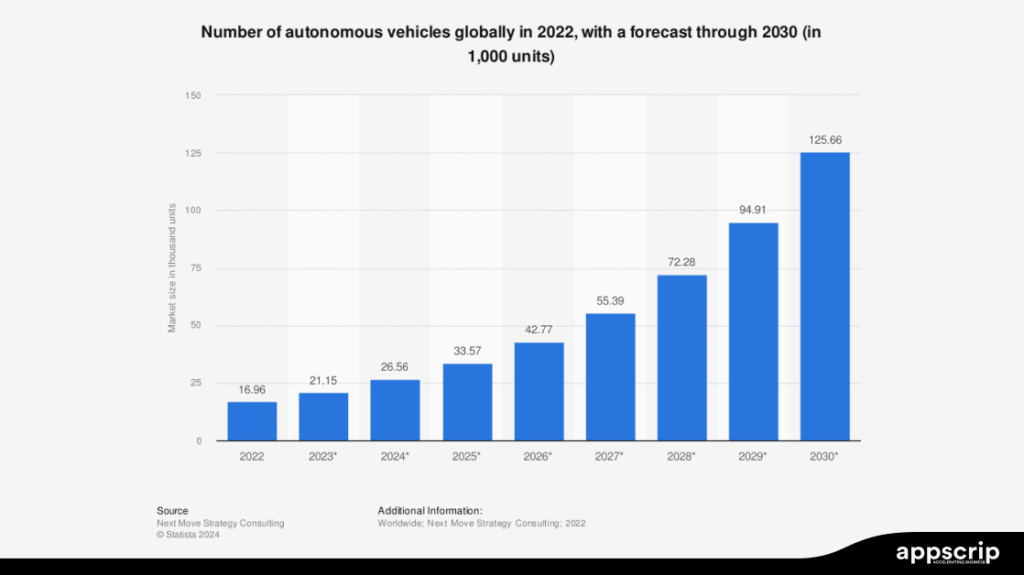

If you’re in tech or the startup world, this isn’t just cool tech, it’s a real shot at building something big. The autonomous vehicle market is expected to hit $614 billion by 2030, and robotaxis are right at the heart of it.

In this guide, we’ll break down what the robotaxi business model actually looks like, what it takes to launch one, and why it’s worth paying attention to in 2025.

TL;DR

- Self-driving, electric vehicles that offer ride-hailing services without a human driver.

- Focuses on fleet operations, pricing strategies, and scalable tech infrastructure

- Includes per-ride fares, dynamic pricing, subscriptions, in-car ads, B2B partnerships, and data licensing

- The autonomous vehicle market is expected to reach $614 billion by 2030, with robotaxis leading the charge

- Regulatory hurdles, public trust, and safety standards are key challenges

Appscrip provides customizable ride-hailing app solutions built for fast launch and long-term growth

What is a Robotaxi?

A robotaxi is an autonomous vehicle designed specifically to offer ride-hailing services without a human driver. These vehicles use a combination of AI, sensors, cameras, GPS, and LIDAR to navigate urban environments. Most robotaxis today are electric and rely on continuous data processing to avoid obstacles, follow traffic rules, and ensure passenger safety.

Key characteristics include:

- Full autonomy: Operating at SAE Level 4 or 5, handling most driving scenarios independently

- Electric powertrains: Most use electric vehicles for lower operational costs

- Advanced sensors: Combination of cameras, radar, and often LiDAR creating 360-degree awareness

- AI decision-making: Neural networks processing sensor data for real-time driving decisions

- Connectivity: Constant communication with cloud platforms for routing and management

Robotaxis can operate 20+ hours daily (versus 8-10 for human drivers) serving 30-40 riders per day, which allows the ride hailing companies to significantly improve efficiency over traditional options.

Evolution from Traditional Taxis to Autonomous Vehicles

The progression to robotaxis represents a compressed transportation revolution:

- Traditional taxis (1890s-2000s): Professional drivers with centralized dispatch

- Ride-hailing apps (2009-present): Direct driver-rider connections via smartphones

- Early autonomy testing (2016-2020): Safety driver-monitored autonomous vehicles

- Limited robotaxi deployment (2020-2023): Restricted commercial operations in geofenced areas

- Expanding services (2023-2025): Growing operational domains with companies like Waymo, Cruise, and Tesla

Key Components of the Robotaxi Business Model

Fleet Management and Operations

The backbone of any successful robotaxi business lies in its fleet management approach. Unlike traditional ride-hailing where drivers maintain their own vehicles, robotaxi companies typically own and operate large fleets of autonomous vehicles.

Effective fleet management includes:

- Vehicle deployment: AI-powered systems determine where cars should be positioned based on real-time demand, historical ride data, and location-specific trends.

- Maintenance and software updates: Autonomous vehicles need frequent diagnostics, sensor recalibrations, and over-the-air software upgrades to stay sharp and safe.

- EV charging cycles: Ensuring robotaxis are charged and ready to go during high-demand hours requires real-time energy management and charging station logistics.

- Driver and passenger app interface: A smooth, responsive app for booking rides, tracking vehicle arrival, and managing payments is essential. This is where user experience begins. Pre-built solutions offered by Appscrip can fast-track development and help you get to market faster.

- Route optimization: Reducing idle time, improving pick-up efficiency, and avoiding traffic bottlenecks can directly impact ride volume and customer satisfaction.

- Incident handling: If a vehicle breaks down or an unexpected event occurs, there must be a control center ready to step in with remote diagnostics or recovery plans.

- Fleet analytics dashboard: Operators need tools to track everything from trip counts to energy usage to customer feedback, helping improve efficiency with each ride.

Pricing and Revenue Models

Robotaxi business model have a lot more monetization options than just collecting fares from passengers.

- Ride-based fares: The most obvious way of charging passengers per ride, much like Uber or Lyft. The absence of a driver slashes one of the biggest operating costs and allows for more competitive pricing.

- Surge and dynamic pricing: Algorithms adjust fares in real time based on demand, traffic, weather, and time of day. This keeps vehicle use optimized and revenue per mile higher during peak hours.

- In-vehicle advertising: Equip robotaxis with digital screens or audio ads that show targeted promotions based on rider profiles, trip history, or location.

- Subscription models: Riders can opt for flat monthly fees in exchange for discounted or unlimited rides, helpful for commuters or frequent travelers.

- Brand collaborations and B2B deals: Partner with hotels, events, or retail chains to offer exclusive drop-off and pickup experiences or loyalty tie-ins.

- Last-mile transit solutions: Integrate with public transit systems to bridge gaps between stations and destinations, with governments or agencies covering part of the cost.

- Data services: Sell anonymized mobility data to city planners, advertisers, and real estate developers who want insights into commuter patterns and urban flow.

The revenue structure differs significantly from traditional ride-hailing, with approximately:

- 60-65% going to vehicle costs and depreciation

- 15-20% to technology and operations

- 10-15% to charging/energy costs

- 10-15% profit margin (compared to 5-7% for traditional ride-hailing)

Without driver compensation (which accounts for 70-75% of traditional ride-hailing costs), robotaxi operators can potentially offer lower prices while maintaining higher margins.

Technology and Infrastructure Requirements

The technology stack powering robotaxi business model represents one of the most complex deployments in modern transportation:

- Autonomous driving system: The core AI technology, incorporating perception, prediction, planning, and control functions. Development costs typically range from $1-5 billion.

- Vehicle hardware: Purpose-built autonomous vehicles cost $70,000-$150,000 each, though prices are expected to drop to $50,000-$70,000 by 2026.

- Mapping and localization: High-definition maps with centimeter-level accuracy, requiring ongoing updates.

- Cloud infrastructure: Massive computational resources for training AI models and processing fleet data. A typical robotaxi generates 5-10 TB of data daily.

- Communication networks: Reliable 5G connectivity for vehicle-to-everything (V2X) communication.

- Physical infrastructure: Dedicated pickup/dropoff zones and charging stations.

This capital-intensive approach explains why most robotaxi ventures are backed by large tech companies, automakers, or substantial venture capital investments.

Market Opportunities and Challenges

Urban Mobility Integration

Robotaxis are becoming integral pieces of the broader urban mobility ecosystem. The most promising opportunities lie in seamless integration of:

- First/last mile connections: Solving the perennial challenge of connecting commuters to public transit. Studies suggest this could increase public transit usage by 20-25% in applicable areas.

- Multi-modal transportation platforms: Apps that combine robotaxis with public transit, micromobility, and other options to provide optimal door-to-door journeys.

- Smart city integration: Connected robotaxis sharing data with traffic management systems to optimize flow and reduce congestion by up to 15% in pilot programs.

- Underserved area coverage: Providing reliable transportation in areas with limited public transit or traditional taxi service. In early deployments, 30% of robotaxi rides were in previously underserved neighborhoods.

Several cities including Phoenix, San Francisco, and Singapore are already incorporating robotaxis into their transportation masterplans, viewing them as complementary rather than competitive to existing public transit systems.

Regulatory and Safety Considerations

Perhaps no challenge looms larger for robotaxi businesses than navigating the complex regulatory landscape:

- Permitting and approval processes: Varying by jurisdiction, with requirements ranging from simple registration to extensive testing protocols and data sharing.

- Insurance frameworks: New models emerging to cover autonomous vehicles, with premiums currently 30-50% higher than conventional commercial vehicles.

- Safety standards: Evolving expectations that robotaxis must be demonstrably safer than human drivers. The industry benchmark is moving toward proving safety rates 10x better than human drivers.

- Liability questions: Ongoing legal debates about responsibility in the event of accidents, shifting from driver liability to manufacturer and operator liability.

- Data privacy regulations: Requirements for handling the massive amounts of sensor data, which may include inadvertent recordings of pedestrians and surroundings.

Safety statistics from pioneering deployments are promising but limited. Waymo vehicles have driven over 20 million miles with accident rates approximately 85% lower than human-driven vehicles in similar conditions.

Competitive Landscape and Key Players

The robotaxi market features several distinct competitor categories:

- Technology-first companies: Waymo (Alphabet), Cruise (GM), and Zoox (Amazon) have developed purpose-built robotaxis without steering wheels or pedals. These companies have raised $10-20 billion each and are focused on perfecting the technology before rapid scaling.

- Automotive manufacturers: Tesla, Mercedes-Benz, and Volvo are adapting consumer vehicles with autonomous capabilities. Tesla alone has over 160,000 vehicles with Full Self-Driving beta capabilities collecting data.

- Ride-hailing platforms: Uber and Lyft are pursuing hybrid strategies, partnering with autonomous technology providers while maintaining their networks and customer relationships.

- Regional specialists: Companies like WeRide (China), Yandex (Russia), and May Mobility (US) focusing on specific geographic markets with adapted approaches.

Market share is currently concentrated in limited commercial deployments, with Waymo leading at approximately 700 daily robotaxi trips in San Francisco and Phoenix as of early 2025.

The market appears to be following a “winner-takes-most” trajectory in individual cities, with early entrants establishing significant advantages through data collection and regulatory relationships.

Implementing a Successful Robotaxi Business Model

Strategic Partnerships and Collaborations

The capital-intensive nature and cross-disciplinary requirements of robotaxi operations make strategic partnerships very important:

- Automaker partnerships: Providing vehicle platforms or manufacturing capabilities. Cruise’s partnership with GM and Waymo’s with Jaguar Land Rover is an example of this approach, reducing vehicle costs by approximately 30% compared to custom-built alternatives.

- Technology collaborations: Combining strengths in different components of the autonomous stack. The Intel/Mobileye/BMW consortium demonstrates how hardware, software, and vehicle design expertise can be unified.

- Infrastructure alliances: Working with charging network providers, parking facility operators, and real estate developers. ChargePoint’s partnership with multiple robotaxi operators has increased charging point availability by 45% in key deployment zones.

- Public-private partnerships: Engaging with cities and transit authorities. In Columbus, Ohio, a robotaxi pilot program created in partnership with the city increased transit ridership by 18% through strategic first/last mile connections.

Effective partnership structures typically involve clear exclusivity boundaries, data sharing agreements, and joint planning processes. Most successful robotaxi ventures maintain 5-10 strategic partnerships across different domains.

Leveraging Data and Technology for Efficiency

Beyond the core autonomous driving technology, successful robotaxi businesses distinguish themselves through operational technology:

- Predictive demand modeling: Using historical patterns, event calendars, weather forecasts, and other variables to predict demand up to 24 hours in advance with 85-90% accuracy.

- Dynamic fleet optimization: AI-driven rebalancing systems that continuously reposition vehicles based on predicted demand, reducing empty miles by up to 40% compared to reactive systems.

- Preventive maintenance algorithms: Systems that identify potential vehicle issues before they cause breakdowns, reducing maintenance costs by 25-30%.

- Energy optimization: Smart charging schedules and routing that consider battery conditions, electricity costs, and upcoming demand, extending battery life by up to 20%.

- Continuous improvement loops: Using operational data to refine both driving and business algorithms, creating compounding advantages over time.

User Experience and Customer Satisfaction

Despite all the technology involved, robotaxis remain fundamentally a consumer service business where user experience dictates success:

- Intuitive app interfaces: Booking flows requiring 30-40% fewer steps than traditional ride-hailing, with accessibility features for diverse user needs.

- Vehicle interior design: Purpose-built robotaxis featuring spacious cabins with amenities like Wi-Fi, charging ports, and entertainment options that increase rider satisfaction scores by 25% compared to converted conventional vehicles.

- Communication systems: Clear in-vehicle and app-based information about routes, stops, and unexpected changes, reducing user anxiety around autonomous travel.

- Personalization: Saved preferences for temperature, music, and routing priorities that follow users across vehicles.

- Trust-building features: Live camera feeds, vehicle status information, and transparent explanations of vehicle decisions that have increased trust metrics by over 50% in early deployments.

Early robotaxi deployments have seen customer satisfaction rates averaging 4.7/5 stars, higher than traditional ride-hailing average of 4.3/5. The top-cited reasons for user satisfaction include consistent vehicle cleanliness (no variable driver standards), predictable driving behavior, and the novelty factor.

Future Trends and Predictions

Advancements in Autonomous Technology

The next few years will bring huge leaps in autonomous driving capabilities. We’re already seeing more Level 4 vehicles, those that can drive themselves without human input in most conditions hitting the road. Level 5, which involves full autonomy in all environments, is still being tested, but it’s not as far off as it once seemed.

What’s driving this progress?

- Better AI decision-making: AI is becoming more capable of predicting and reacting to real-world road conditions.

- Neural networks and machine learning: These systems learn from every trip, making the vehicles smarter over time.

- Advanced simulation and real-world training: Robotaxis are logging millions of virtual and physical miles to refine their performance.

- Powerful onboard hardware: Companies like NVIDIA are building next-gen chips that can process real-time driving data faster and more safely.

Impact on Public Transportation Systems

Robotaxis won’t replace buses or trains, but they’ll change how we use them. Instead of competing, they’ll work as connectors bridging the gap between your front door and the nearest station.

Here’s how they’ll fit into the ecosystem:

- First-mile and last-mile solution: Perfect for areas that public transport doesn’t fully reach.

- Night and off-peak coverage: Useful when buses and subways stop running.

- Flexible routing: Unlike fixed-route systems, robotaxis can respond dynamically to changing passenger demand.

Expansion into Global Markets

While the U.S. is leading many pilot programs, the global robotaxi race is gaining serious momentum. International markets are preparing to adopt this tech, often with strong government backing and clear roadmaps.

Markets to watch include:

- China: Baidu’s Apollo Go is expanding across several cities, offering rides to the public.

- United Arab Emirates: Dubai is targeting 2030 to roll out a full-scale autonomous taxi network.

- Europe: Cities in Germany and France are exploring localized robotaxi deployments with a focus on green energy integration.

The combination of AI, real-time data, and electric vehicle tech has opened up a model that’s leaner, smarter, and potentially far more scalable than anything we’ve seen before.

For tech entrepreneurs and startups, this is your window. The market is still open, the tech is ready, and cities are warming up to the idea of autonomous mobility. Whether you’re thinking of launching your own fleet or building a platform around the ecosystem, having the right tech partner matters.

At Appscrip, we work with startups and entrepreneurs to get ride-hailing platforms up and running without long development cycles. Whether you’re testing things out in one city or planning to scale big, we’ve already built the tools to help you move quicker.

Here’s what we bring to the table:

- Custom-built taxi app solutions you can shape around your business

- Pre-built rider and driver apps that cover everything from booking to payments

- A smart admin panel to manage trips, vehicles, and performance

- Tech that scales so you’re ready when it’s time to grow

Robotaxis are picking up speed. If you want to be part of where this industry is headed, let’s team up and build something that lasts.

Ready to take the first step? Let’s build your Robotaxi App together.