Ever thought about building the next big food delivery platform? You’re not alone. With millions of people relying on apps like DoorDash for their daily meals, the market is booming, and the opportunity has never been bigger.

The question is, how do you stand out in a space dominated by giants?

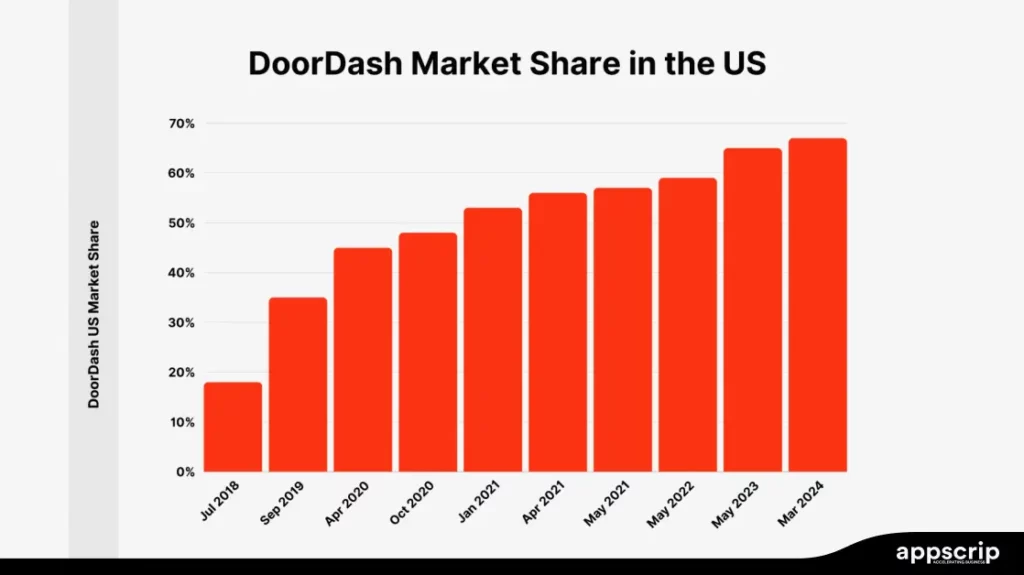

Let’s take a step back. DoorDash wasn’t always the industry leader. In 2013, four Stanford students launched a small delivery service, and today, it controls 67% of the U.S. food delivery market. It didn’t happen by luck. While competitors fought over big cities, DoorDash focused on suburban expansion, secured exclusive restaurant partnerships, and introduced a subscription model that keeps customers loyal.

If you’re serious about launching a successful food delivery business, understanding what works, what doesn’t, and how to scale profitably is key. But here’s the reality – building from scratch is expensive, time-consuming, and filled with technical hurdles. What if you could bypass all that and launch quickly with a proven system?

That’s where a pre-built food delivery solution comes in. No need to start from zero, get the technology, features, and infrastructure you need to compete effectively from day one.

TL;DR

- DoorDash’s Business Model: A three-sided marketplace connecting customers, restaurants, and Dashers with AI-driven logistics.

- Revenue Streams: Earns from restaurant commissions (15-30%), delivery fees, DashPass subscriptions, ads, and last-mile logistics.

- Scaling Smartly: Uses AI-powered Deep Red to optimize delivery times, reduce costs, and dynamically adjust pricing.

- Key Lessons: Focus on underserved markets, secure strong restaurant partnerships, leverage AI, and diversify revenue streams.

- Monetization Strategy: Balance commissions, subscriptions, and advertising while introducing premium services strategically.

- Faster Launch: A pre-built, customizable solution helps launch quickly and scale efficiently.

The Secret Behind DoorDash’s Market Dominance

How DoorDash Rules the Market

Most food delivery startups struggle to scale in presence of bigger competitors, but DoorDash took a different path. It built a logistics powerhouse that now spans over 7,000 regions across all 50 U.S. states, with international expansions into Canada and Australia.

The secret? A hyper-targeted market entry, exclusive restaurant partnerships, and a logistics system that keeps deliveries fast and costs low.

Hyperlocal Expansion Strategy: Winning in Underserved Markets

Instead of jumping into high-density metro areas where Uber Eats and Grubhub were already established, DoorDash started in suburban markets of Palo Alto where there were fewer options for food delivery. This gave them a first-mover advantage in regions with high demand but low competition, helping them lock in customers and restaurants before their rivals arrived.

By creating strong local partnerships, DoorDash built a foundation that made it easier to expand into major cities later with a more loyal user base and better restaurant relationships. Today, DoorDash serves 67% of the U.S. food delivery market, proving that starting where others ignored was a game-changing decision.

AI-Driven Logistics: Faster Deliveries, Lower Costs

While most competitors relied on basic dispatching, DoorDash invested heavily in AI-powered routing, order batching, and driver optimization to minimize costs and delivery times.

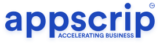

Their ‘Deep Red’ technology prioritizes efficiency, matching the right Dasher to the right order at the right time, ensuring fewer delays and better service. With over 2.5 billion orders fulfilled globally, it’s clear that logistics is not just a component for DoorDash, it’s the engine that drives its business.

Restaurant-First Approach: A Key Competitive Advantage

DoorDash prioritized restaurant relationships by offering tiered commission plans, allowing businesses to choose a pricing model that worked best for them. Unlike Uber Eats, which took a more transactional approach, DoorDash built long-term partnerships with restaurants, leading to exclusive contracts with major chains.

This exclusivity gave DoorDash an edge in customer loyalty. If people wanted food from a specific restaurant, they had to order through DoorDash.

DashPass Subscription Model: Customer Retention at Scale

Instead of relying solely on transaction-based revenue, DoorDash introduced DashPass ($9.99/month), which gives customers unlimited free deliveries on eligible orders. This subscription model not only increases order frequency but also locks in customers – a DashPass user is far less likely to switch to Uber Eats or Grubhub.

With millions of active subscribers, DashPass has become a major revenue driver, reducing the company’s reliance on delivery fees alone.

Why Postmates Failed, and DoorDash Succeeded

Postmates entered the market early and had a first-mover advantage, yet it struggled to scale efficiently, differentiate itself, and generate profitability, leading to its acquisition by Uber Eats for $2.65 billion in 2020.

- Market Positioning: Choosing the Right Entry Point Matters – Postmates focused on launching in dense urban areas where Uber Eats and Grubhub were already well-established. Competing head-to-head in saturated markets made it difficult to gain traction.

- Exclusive Partnerships: Securing Long-Term Competitive Advantages – Postmates operated as an open marketplace, meaning it lacked exclusivity and was interchangeable with other delivery apps. Meanwhile DoorDash negotiated exclusive deals with large restaurant chains, ensuring that customers could only order from certain places through their platform.

- Operational Efficiency: The Role of Logistics and AI – Postmates did not invest enough in intelligent order batching and routing, leading to higher delivery costs per order.

- Customer Retention: The Power of Subscriptions – Postmates relied entirely on transaction-based revenue, which made customer retention difficult. DoorDash introduced DashPass, a subscription model that incentivizes customers to order more frequently, ensuring repeat business.

- Scalability and Long-Term Sustainability – Despite raising $900 million in funding, Postmates struggled to turn a profit, while DoorDash optimized its operations and diversified its revenue streams.

DoorDash’s Infamous YC Pitch & What Investors Saw

When DoorDash pitched at Y Combinator’s 2013 batch, it wasn’t the smooth, high-production presentation you might expect from a billion-dollar company in the making. The UI was clunky, the transitions were laggy, and the demo was filled with awkward pauses.

By traditional pitching standards, it was far from perfect. Yet, investors weren’t looking for polish, they were looking for potential. And DoorDash had plenty of it.

A Rough Demo, But a Brilliant Model

At first glance, nothing about the pitch screamed “future industry leader.” The app’s interface was basic, the functionality was minimal, and it lacked the sleekness of well-funded competitors. But what made the pitch stand out wasn’t the technology, it was the problem they were solving.

Unlike Uber Eats and Postmates, which were laser-focused on urban markets, DoorDash identified an untapped suburban demand. In these areas, restaurants had limited access to reliable delivery solutions, and consumers had few options for getting meals from their favorite local spots.

The DoorDash founders understood that while cities were crowded with food delivery options, village and suburban restaurants needed a logistics partner, not just another marketplace.

What Investors Saw Beyond the Demo

Y Combinator investors weren’t distracted by the rough presentation. Instead, they recognized key advantages in DoorDash’s model:

- A Market Others Ignored – While competitors battled for market share in major cities, DoorDash quietly built a stronghold in suburban areas, where demand was high but supply was low.

- A Logistics-Focused Approach – Rather than just listing restaurants, DoorDash saw delivery as an operations and efficiency problem, something they could solve with smart logistics and technology.

- A Scalable, Repeatable Model – Investors saw that DoorDash’s playbook of partnering with local restaurants, perfecting delivery logistics, and expanding strategically was something that could work across different regions and even industries.

- A Team That Understood Execution – Even with an unimpressive UI, the DoorDash team showed they could move fast, test their model, and refine it as they scaled.

Competitive Analysis: How DoorDash Stacks Up Against Others

DoorDash operates in a highly competitive market, with Uber Eats and Grubhub being its primary rivals. Each company has taken a different approach to food delivery, impacting their growth, market share, and profitability.

| Factor | DoorDash | Uber Eats | Grubhub |

| Market Share (2024) | 67% | 23% | 10% |

| Geographic Focus | U.S., Canada, Australia | Global (U.S., Europe, Asia) | Primarily U.S. |

| Business Model | Marketplace & Logistics | Marketplace & Logistics | Marketplace Only |

| Subscription Model | DashPass ($9.99/month) | Uber One ($9.99/month) | Grubhub+ ($9.99/month) |

| Restaurant Partnerships | Exclusive contracts with major chains | Strong partnerships, less exclusivity | Large chain focus, fewer exclusives |

| Delivery Logistics | AI-powered route optimization | Rideshare driver integration | Traditional delivery model |

| Revenue Diversification | Delivery fees, commissions, ads, subscriptions | Delivery fees, commissions, ads, subscriptions | Delivery fees, commissions |

| Expansion Beyond Food | Grocery, retail, alcohol via DashMart | Grocery, pharmacy, retail | Limited expansion |

| Operational Efficiency | AI-driven dispatch, order batching | Shared drivers with Uber Rides | Less focus on logistics optimization |

DoorDash’s focus on logistics, exclusive deals, and a strong subscription model has allowed it to maintain market dominance.

The DoorDash Business Model: A Blueprint for Food Delivery Success

The Three-Sided Marketplace: Customers, Restaurants, and Dashers

DoorDash operates as a three-sided marketplace, ensuring that customers, restaurants, and Dashers (a.k.a drivers) each benefit from the platform.

Customers: Customers use DoorDash because it offers speed, variety, and reliability. With access to thousands of restaurants, grocery stores, and retailers in a single app, users can schedule deliveries, track orders in real time, and get discounts through DashPass.

Restaurants: For restaurants, DoorDash is a gateway to a larger customer base without requiring them to manage their own delivery logistics. With tiered commission plans, restaurants can decide whether they want broader reach, lower costs, or additional promotional tools to boost their sales.

Dashers: DoorDash’s gig workforce is the backbone of its delivery network. The platform ensures fairer pay, optimized routes, and peak-hour incentives to attract and retain Dashers. Unlike traditional jobs, Dashers can work whenever and wherever they want.

Revenue Streams: How DoorDash Makes Money

DoorDash has built a multi-revenue model that allows it to remain profitable despite the challenges of food delivery. By diversifying its income sources, it ensures long-term sustainability.

| Revenue Stream | DoorDash | Uber Eats | Grubhub |

| Delivery Fees | Customers pay per order based on distance, demand, and restaurant selection. | Similar fee structure with dynamic pricing. | Standard delivery fees but lacks dynamic adjustments. |

| Restaurant Commissions | 15-30% per order, with tiered pricing for different service levels. | 20-30% per order. | 15-25% per order. |

| Subscriptions | DashPass ($9.99/month) provides free delivery and lower service fees. | Uber One ($9.99/month) includes both Uber Eats and Uber rides. | Grubhub+ ($9.99/month) offers free delivery on select orders. |

| Advertising | Restaurants pay for premium placement in search results. | Strong ad model with bundled services. | Less emphasis on paid visibility compared to DoorDash. |

| White-Label Logistics | DashMart and last-mile delivery services for grocery and retail partners. | Expanding into grocery and pharmacy delivery. | Limited expansion beyond food. |

How DoorDash Scales Without Breaking the Bank

DoorDash has found ways to grow without massively increasing costs by making every part of its operation more efficient. This is why, despite tough competition, it continues to lead the market.

Deep Red: The AI Brain Behind DoorDash’s Efficiency

One of DoorDash’s most powerful tools is Deep Red, its AI-powered logistics system that optimizes deliveries in real time. Deep Red constantly evaluates traffic patterns, driver availability, restaurant preparation times, and order volumes to make deliveries as efficient as possible. This system ensures:

- Smarter Dispatching: Orders are automatically assigned to the closest and most efficient Dasher, reducing wait times.

- Predictive Routing: Deep Red calculates the fastest possible route for each order, cutting down on delays and fuel costs.

- Better Order Batching: Multiple orders from nearby restaurants are grouped and sent out in a single trip, making each Dasher’s run more productive.

By continuously learning and improving, Deep Red helps DoorDash reduce operational costs and increase delivery speed, keeping both customers and Dashers satisfied.

Maximizing Every Delivery: Smarter Logistics

Instead of just hiring more Dashers, DoorDash focuses on getting more done with fewer resources. This means:

- Order Stacking: Multiple orders from nearby restaurants are bundled together, allowing Dashers to complete multiple deliveries in one go.

- Smart Traffic Mapping: AI-powered traffic forecasting helps drivers avoid congestion, ensuring food arrives faster and fresher.

- Idle Time Reduction: Predictive dispatching keeps Dashers active, reducing wait times and maximizing earnings per shift.

Data-Driven Pricing and Demand Forecasting

DoorDash doesn’t set prices randomly. It analyzes real-time demand, order complexity, and traffic conditions to dynamically adjust fees. This means:

- Time of day and peak demand: Higher delivery fees during busy hours help attract more Dashers to meet demand.

- Distance and complexity: Longer trips and complicated orders come with higher service fees, ensuring DoorDash remains profitable.

- Customer behavior: Discounts and promotions are targeted using AI-driven insights, ensuring that incentives drive real revenue growth instead of just temporary spikes.

Beyond Food: Expanding Into Retail and Grocery

With the global online grocery market projected to reach $1.65 trillion by 2028, it’s clear why the company is expanding into grocery, alcohol, and retail. This move is about staying relevant as consumer behavior shifts toward on-demand everything.

- Grocery and Convenience Store Partnerships: DoorDash now delivers from major chains like Walmart, Albertsons, and CVS, offering same-day delivery.

- DashMart Growth: With 2,500+ locations, DashMart now delivers household essentials, snacks, and even over-the-counter medications.

- Retail Expansion: DoorDash has moved into last-mile delivery for big-box stores, pet retailers, and pharmacy chains, making it a key player beyond food.

What’s Next for DoorDash? Expanding Beyond Food

DoorDash is evolving into a full-scale logistics platform, leveraging its technology, partnerships, and infrastructure to dominate beyond restaurants.

- Grocery and Multi-Category Expansion: DoorDash is rapidly growing in grocery, convenience, and retail delivery, competing with Instacart and Amazon Fresh. It now partners with over 100,000 grocery and retail stores.

- DashMart and Non-Food Deliveries: DashMart is expanding, with 2,500+ locations offering household essentials, pet supplies, and even over-the-counter medicine, making DoorDash an all-in-one delivery platform.

- International Expansion: After its $8 billion acquisition of Wolt, DoorDash has entered 30+ countries, growing its presence in Europe and Asia and competing with international delivery leaders.

DoorDash’s long-term vision is clear: it wants to be the default platform people prefer for all on-demand deliveries including groceries, convenience, and retail.

Launching Your Own DoorDash-like Platform? Here’s How To Do It Right

With consumer habits shifting towards on-demand services, there has never been a better time to start your own food delivery platform. And it’s not easy either, as we have seen from Postmates’ case.

Must-Have Features for Your Platform

Customers want speed and convenience, restaurants need seamless integrations, and drivers expect efficient routing and fair earnings. Here’s what your platform needs to succeed:

AI-Powered Dispatch and Real-Time Order Tracking: If customers wait too long, they switch to competitors. Smart dispatching ensures orders are assigned to the closest and most efficient driver, cutting down delivery time. Real-time tracking keeps customers engaged and reassures them that their food is on its way.

Subscription-Based Loyalty Models: DoorDash’s DashPass ($9.99/month) contributed to a 43% increase in repeat orders. Why? Because customers love savings. A subscription model offering free delivery and priority orders can turn casual users into lifetime customers. This model increases order frequency and builds predictable revenue.

Instead of just offering discounts, you could bundle perks like exclusive restaurant deals, faster deliveries, or even cashback offers to maximize retention.

Advanced Analytics for Demand Forecasting: Your platform should predict what customers want before they order. AI-driven analytics help optimize pricing, manage peak-hour demand, and suggest restaurants based on user behavior. This is how you boost efficiency while increasing revenue per user. Top delivery platforms that use predictive analytics see a 20-25% increase in revenue per active customer.

Seamless Restaurant and Driver Onboarding: Your platform should make it ridiculously easy for restaurants and drivers to sign up. Automated menu uploads, earnings tracking, and instant payouts reduce friction. The smoother the onboarding, the faster you scale.

Pre-built delivery platforms already have plug-and-play onboarding features, allowing you to start signing up restaurants and drivers within a day.

Secure and Flexible Payment Options: A food delivery platform should support credit/debit cards, digital wallets, and instant payouts for drivers. In a cashless economy, secure transactions ensure trust and reliability.

Build From Scratch vs. Pre-Built Solution: What’s the Better Choice?

One of the biggest decisions entrepreneurs face is whether to build a food delivery platform from scratch or use a pre-built white-label solution. Below is a detailed comparison of both approaches.

| Factor | Custom Development | Pre-Built Solution |

| Time to Market | 12-18 months | 4-8 months |

| Cost | $100K – $500K | $15K – $50K |

| Technical Complexity | Requires in-house development team and IT infrastructure | Fully developed solution with ongoing support |

| Customization | Fully customizable but takes time | Highly customizable, ready to launch faster |

| Scalability | Requires additional development and resources | Scalable out-of-the-box with updates included |

| Risk Factor | High risk due to development challenges and unforeseen costs | Lower risk with proven models already functioning |

| Integration Readiness | Requires separate integrations for payment gateways, logistics, and analytics | Comes with built-in integrations for payments, tracking, and analytics |

If you’re aiming for rapid market entry and cost efficiency, using a ready-made, customizable platform is a smarter move, allowing you to focus on growth rather than technical challenges.

Building a Scalable and Profitable Delivery Business: What Entrepreneurs Need to Know

Many food delivery startups fail because they chase rapid growth before building a business that is profitable and scalable. The reality is that scaling too fast without optimizing costs, operations, and revenue streams leads to high burn rates and failure.

Find and Dominate an Underserved Market First

When DoorDash started, it didn’t go head-to-head with Uber Eats in major metro areas. Instead, it focused on suburban regions where demand was high, but competition was low. This allowed the company to gain market traction without overspending on customer acquisition.

- Identify geographic areas or delivery niches that competitors are neglecting.

- Launch in regional cities, university towns, or high-demand localities with fewer existing delivery options.

- Use publicly available data and research consumer behavior to pinpoint gaps in current food delivery services.

Build Exclusive Restaurant Partnerships

Restaurants are the backbone of your platform. If they depend on your platform for a large share of their online sales, they are less likely to switch to a competitor. DoorDash secured exclusive partnerships with major chains, ensuring customers had to use their platform for certain brands.

- Offer flexible commission structures so restaurants feel they are getting real value.

- Provide marketing tools, analytics, and promotions that help restaurants increase orders.

- Prioritize signing local favorites and niche restaurants that competitors have overlooked.

Use AI to Improve Efficiency and Cut Costs

Food delivery operates on thin margins, so efficiency is everything.

- Use smart dispatching to assign deliveries to the nearest and most efficient driver.

- Implement predictive routing to avoid traffic congestion and reduce delays.

- Analyze customer demand and adjust pricing dynamically based on peak hours and distances.

Focus on Customer Retention, Not Just Acquisition

Many startups burn money on customer acquisition without a clear retention strategy. DoorDash increased repeat orders by 43% through its subscription model, loyalty programs, and personalized promotions.

- Offer discounts and exclusive deals to keep customers coming back.

- Use data-driven personalization to recommend restaurants and meal choices.

- Implement a referral program that rewards users for bringing in new customers.

Build for Scalability From Day One

Expanding a delivery business is not just about entering new cities. It requires a technology stack that can handle higher order volumes without increasing costs.

- Choose a pre-built, AI-driven logistics solution to manage scaling without excessive hiring.

- Automate customer service, restaurant onboarding, and driver payouts to reduce overhead.

- Diversify into high-demand categories like grocery, alcohol, and pharmacy delivery to maximize revenue potential.

Mastering Your Revenue Model: The Entrepreneur’s Playbook

The key to a good revenue model is finding the right mix of commissions, subscriptions, advertising, and premium services that generate consistent income without alienating key stakeholders.

Which Revenue Model Should Startups Prioritize?

Many startups rely heavily on commissions from restaurants, which can limit scalability and make profitability difficult. The most sustainable platforms blend multiple revenue sources to maximize earnings while ensuring long-term customer retention.

What works best?

- Commissions: Still a core revenue stream, but it should be competitive and offer flexible pricing tiers.

- Subscriptions: A stable and recurring income source that keeps users engaged and ordering more frequently.

- Advertising: A highly profitable option, where restaurants pay for premium visibility on the platform.

- Service Fees: Dynamic pricing on orders based on delivery distance, demand, and order complexity.

Commissions vs. Subscriptions vs. Advertising: What Works Best for New Entrants?

For a startup entering the food delivery market, balancing revenue streams is important to gaining traction while achieving sustainable growth.

| Revenue Model | Pros | Cons | Best For |

| Commissions | Easy to implement, aligns with order volume | High rates can drive restaurants away | Startups looking for quick monetization |

| Subscriptions | Encourages loyalty and repeat business, stable revenue | Takes time to build a subscriber base | Companies focused on long-term growth |

| Advertising | High margins, restaurants willingly pay for visibility | Requires a large customer base to be effective | Platforms with an established audience |

For early-stage platforms, commissions will likely be the primary revenue driver. However, introducing subscriptions and advertising as the platform scales can diversify income and create long-term profitability.

When Should a Startup Introduce Premium Services or Expand Beyond Food?

Introducing premium features or expanding into new delivery categories too early can drain resources, while waiting too long can allow competitors to take the lead.

Key indicators it’s time to scale beyond food delivery:

- Consistent demand growth: If order volume stabilizes, expanding into new verticals like groceries, alcohol, and retail can increase customer lifetime value.

- High user retention rates: If customers are repeatedly ordering, they are more likely to pay for premium services like priority delivery or exclusive restaurant access.

- Restaurant dependency on your platform: When restaurants generate a significant percentage of their orders from your platform, you can introduce paid marketing tools and premium placement options.

What premium services can be added?

- Faster delivery options for an additional fee.

- Exclusive restaurant deals for subscribed users.

- Loyalty-based rewards programs that increase retention.

- Grocery, retail, and alcohol delivery to diversify revenue and market reach.

For startups, introducing premium features should align with user demand and operational readiness. Using a pre-built, AI-powered food delivery solution can make scaling easier, reducing the need for heavy development investments while enabling faster execution.

Why Entrepreneurs Choose Appscrip for Their Delivery Platforms

Unlike traditional development approaches that require months of coding and massive upfront investments, Appscrip’s solutions provide a faster, more cost-effective way to enter the market without compromising on quality or scalability.

Appscrip’s Food Delivery App Solution Offers:

- 100% Code Ownership – Full control to customize and scale your platform.

- Cost-Effective – Get started at a fraction of the cost of building from scratch.

- Built for Growth – Seamless scalability as your business expands.

- Seamless Integrations – Works with various payment gateways, logistics tools, and third-party apps.

- Tailored for Your Needs – Unlike off-the-shelf solutions, our platform is fully customizable.

Why spend months or years building from scratch when you can launch faster, optimize operations, and start generating revenue immediately?

Your opportunity to dominate the food delivery industry starts now. Get a fully customizable, ready-to-launch food delivery platform designed for growth and efficiency. Contact us today and let’s build a food delivery business that scales and succeeds!